Instant Download

Get Reseller Access

After Sale Support

Limited Time Offer

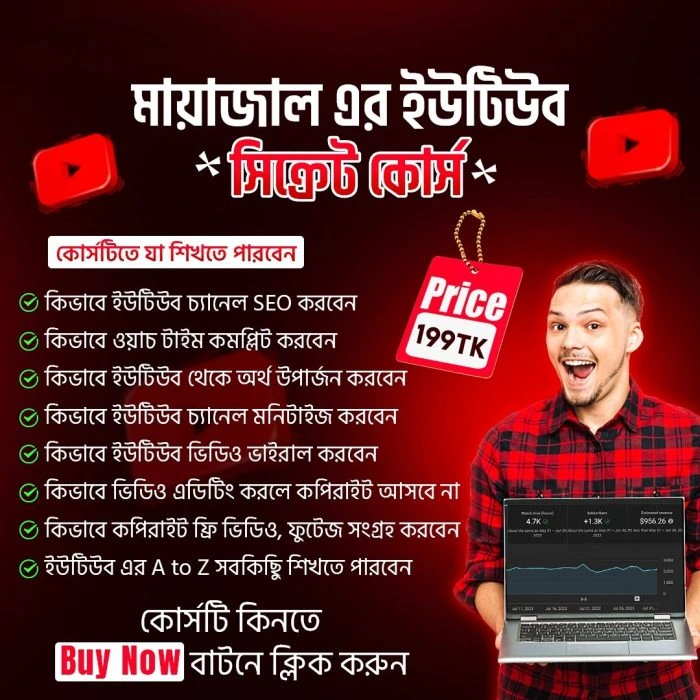

বাংলাদেশ থেকে কিভাবে ইউএস ব্যাংক একাউন্ট খুলবেন তার সম্পূর্ণ গাইডলাইন শিখুন। স্টেপ-বাই-স্টেপ প্র্যাকটিক্যাল মেথড এই কোর্সে রয়েছে। Order from Filehaat (ফাইলহাট) আজই।

৳ 350 Original price was: ৳ 350.৳ 199Current price is: ৳ 199.

Any US Bank Account Opening Full Method (Bangla Guide)

Instant Download

Get Reseller Access

After Sale Support

Limited Time Offer

বাংলাদেশ থেকে কিভাবে ইউএস ব্যাংক একাউন্ট খুলবেন তার সম্পূর্ণ গাইডলাইন শিখুন। স্টেপ-বাই-স্টেপ প্র্যাকটিক্যাল মেথড এই কোর্সে রয়েছে। Order from Filehaat (ফাইলহাট) আজই।

৳ 350 Original price was: ৳ 350.৳ 199Current price is: ৳ 199.

Description

🏦 How to Apply for a U.S. Bank Account: Step-by-Step Guide

Opening a bank account in the United States is easier than you might think. Whether you are a U.S. citizen, resident, or non-resident, having a U.S. bank account helps you enjoy safe savings, smooth international transactions, and modern online banking facilities.

This guide will walk you through why a U.S. bank account is beneficial, what documents you need, which account type to choose, and the exact steps to apply.

💡 Why Open a U.S. Bank Account?

A U.S. bank account gives you access to multiple financial advantages, especially if you live, travel, or do business in the United States.

Key Benefits:

-

🔒 Secure Transactions: FDIC insurance and advanced banking security protect your money.

-

💳 Access to the U.S. Credit System: Essential for building a U.S. credit history.

-

🌍 International Transfers Made Easy: Faster and cheaper global money transfers.

-

📈 Financial Stability: Establishes your financial presence for future residency or business needs.

🏦 Types of Bank Accounts

-

Checking Account: For daily use—paychecks, purchases, debit card, and checks.

-

Savings Account: Earns interest; ideal for storing funds long-term.

-

Certificate of Deposit (CD): Higher interest rates but requires keeping money untouched for a set time.

📋 Requirements for Opening a U.S. Bank Account

For U.S. Residents:

-

Government-issued ID (Driver’s License, Passport)

-

Social Security Number (SSN)

-

Proof of Address (Utility Bill, Lease Agreement)

For Non-Residents:

-

Valid Passport

-

Visa or U.S. entry documentation

-

ITIN (Individual Taxpayer Identification Number, if no SSN)

-

Proof of Foreign Address (in some cases)

⚠️ Note: Not all U.S. banks accept non-resident applications, so confirm before applying.

📝 Step-by-Step Process to Apply

-

Research and Compare Banks → Review account types, fees, and eligibility.

-

Gather Documents → ID, proof of address, SSN/ITIN.

-

Choose Account Type → Checking, savings, or CD.

-

Apply Online or In-Branch → Residents often apply online; non-residents may need in-person visits.

-

Deposit Initial Funds → Typically $25–$100 minimum deposit.

-

Verify Account & Activate Online Banking → Once approved, you can access statements, transfer funds, and manage everything digitally.

🌐 Applying as a Non-Resident

Non-residents need to check which banks welcome international applicants. Many banks require in-person applications. An ITIN is often essential.

Popular Banks for Non-Residents:

-

Wells Fargo

-

Citibank

-

HSBC

🏦 Top Banks in the U.S. (Residents + Non-Residents)

-

Chase Bank → Wide ATM network, strong mobile banking.

-

Bank of America → Easy online services, low minimum deposits.

-

Wells Fargo → International-friendly, large branch network.

-

HSBC → Specialized in international banking for non-residents.

-

Citibank → Global presence, excellent for international clients.

✅ Final Thoughts

A U.S. bank account makes financial management smoother, safer, and more global. By preparing your documents in advance and following these steps, you can speed up the process, avoid account freezes, and enjoy the full benefits of U.S. banking.

Reviews

There are no reviews yet